Building telematics-based insurance products of the future

Thanks to advancements in connected car technologies and the accessibility of personal mobile devices, insurers can roll out telematics-based services at scale. Utilizing telematics data opens the door to improving customer experience, unlocking new revenue streams, and increasing market competitiveness.

After reading this article, you will know:

- What is telematics

- How insurers build PAYD & PHYD products

- Why real-time crash detection is important

- How to identify stolen vehicles

- If it’s possible to streamline roadside assistance

- What role telematics plays in predictive maintenance

Telemetry- the early days

Obtaining vehicle data isn’t a new concept that has materialized with the evolution of the cloud and connectivity technologies. It is called telemetry and was possible for a long time but accessible only to the manufacturers or specialized parties because establishing the connection with the car was not an easy feat. As an example, it first started to be used by Formula 1 racing teams in the late 1980s, and all they could manage was very short bursts of data when the car was passing close to the pits. Also, the diversity and complexity of data were significantly different compared to what is available today because cars were less complex and had fewer sensors onboard that could gather and communicate data.

What is telematics?

At the very basic level, it’s a way of connecting to the vehicle data remotely. More specifically, telematics is a connection mechanism between machines (M2M) enabled by telecommunication advances. Telematics understood in the insurance context is even more specific and means connecting to the data generated by both the vehicle itself and the driver .

At first, when telematics-based products started gaining popularity, they required drivers to use additional devices like black boxes that needed to be installed in the car, sometimes by a qualified technician. These devices were either installed on the dashboard, under the bonnet, or plugged in the OBD-II connector. The black boxes were fairly simple devices that comprised of GPS, motion sensor, and a SIM card plus some basic software. They gathered rudimentary information about:

- the time-of-day customers drive

- the speed on different sorts of roads

- sharp braking and acceleration

- total mileage

- the total number of journeys

Meantime mobile apps mostly replaced black boxes as it didn’t take long for smartphones to get sophisticated enough to render them rather useless. Of course, they are still offered by the insurers as an alternative for customers that refuse to install apps that access their location or require one due to not having a sufficiently advanced mobile device. However, these days most of the cars that roll off the assembly line have built-in connectivity capabilities, so the telematics function is already embedded in the vehicle from the very beginning. As an example, 90% of Ford passenger cars starting from 2020 are connected. This means that there is no more need for additional devices. The car can now share all the data black boxes or apps gathered plus a lot of detailed data about the vehicle state from the massive amount of sensors they’ve got on board. More technologically advanced cars like Tesla can send up to 5 gigabytes of data every day.

Telematics-based insurance products and services

By employing new technologies, insurers can be closer to their customers, understand them better and take a more proactive approach to maintain the relationship. Telematics is the key technology that allows for this type of stance in the auto insurance area. Insurers can leverage telematics to build numerous products and services , but it is important to remember that the regulations can differ from state to state and from country to country.

So, the solutions depicted in this article should serve only as an example of how the technology can be used.

Usage-based products

Usage-based products are probably the most widespread in this category as they have been around for some time and offer the most tangible benefit to customers - cost savings.

The market value for these products is currently estimated at 20 billion dollars, and it is projected to reach 67 billion USD in the next 5 years. This is a good indicator that there is a growing demand in the market, especially from millennials and gen Zs who expect the services & products they buy to be tailored to them and not based on a generic quote.

Currently, the two main categories of usage-based insurance are Pay-how-you-drive (PHYD) and Pay-as-you-drive (PAYD) products. The first one is based on the assumption that the drivers should be rewarded for how they drive. So, when building PHYD offering, insurers need data on when & where their customers drive, the speed on different roads, how they accelerate, and brake, and how they enter corners. Feeding that data to Machine Learning algorithms allows assessing whether the customers are safe drivers who obey the law and to reward them with a discount on their premium. The customer benefits are clear, but the insurer benefits as well. By enabling their customers to use PHYD products, the insurers can:

- correct risk miscalculations,

- enhance price accuracy,

- attract favorable risks,

- retain profitable accounts,

- reduce claim costs

- enable lower premiums

The second category is the PAYD model in which the customers pay only for what they actually drive plus a low monthly rate. In this scenario, the insurers only need to monitor the miles driven and then multiply the amount by a fixed mile fee (a few cents usually). This type of solution is perfect for irregular drivers, and it was also a choice for many during COVID. It can increase insurance affordability, reduce uninsured driving, and provide consumer savings. It makes premiums more accurately reflect the claim costs of each individual motorist and rewards motorists who reduce their accident risk. Additionally, it can be a great alternative to PHYD products for customers who are not comfortable with gathering multiple data points about their driving behavior.

Real-time crash detection

This solution allows insurers to be closer to their customer and to react to events in real-time. It is a part of a larger trend in which the evolution of technology enables the shift from a mode of operations where the insurer is largely invisible to their customers (unless something happens) to a new model where the company is there to support and help the customers. And if possible, even go as far as to predict and prevent losses occur.

By analyzing the vehicle data and driver behavior, it is possible to detect accidents as they happen. Through monitoring the vehicle location, speed, and sensor data (in this case, motion sensor) and setting up alerts, insurers can be the first to know that there has been an accident. However, detecting the actual accident requires filtering out random shock and vibrations like speed bumps, rough roads, and potholes, parking on the kerb, doors, or boot lid being slammed.

This allows them to take a proactive approach and contact the driver, coordinate the emergency services, and roadside assistance. Using the data from the crash, they can also start the first notice of loss process and reconstruct the accident’s timeline. If it happens that there are more parties involved in the incident, the crash data can be used to determine who is responsible in ambiguous situations.

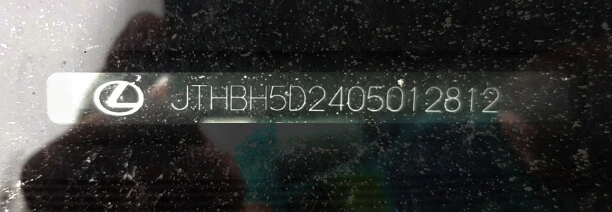

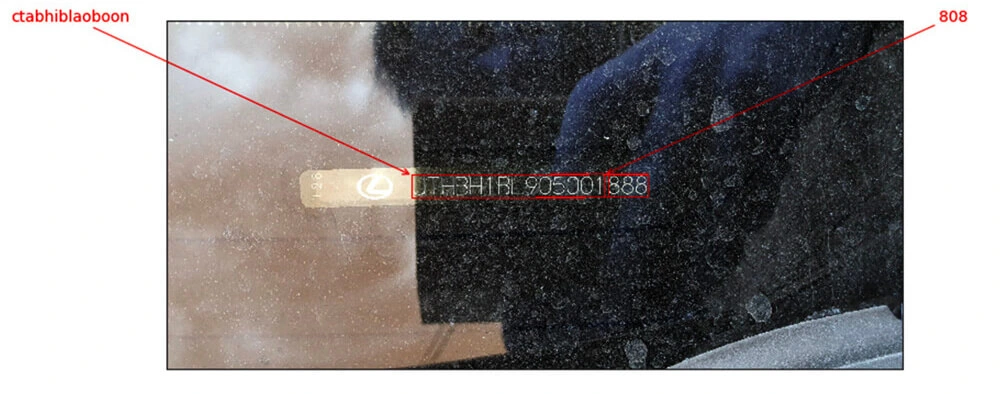

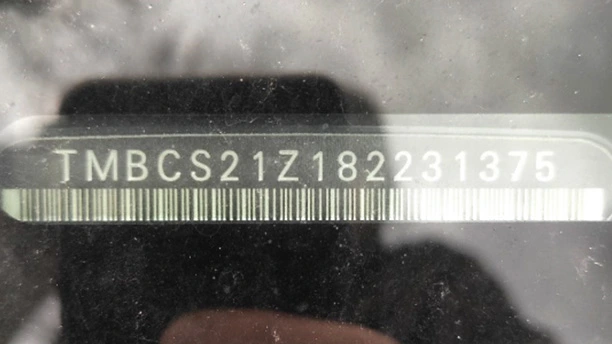

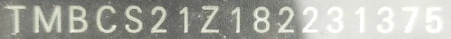

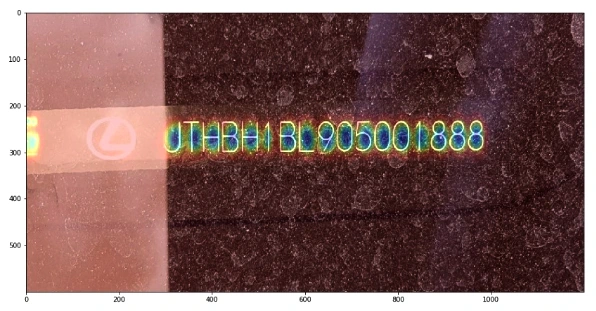

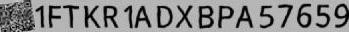

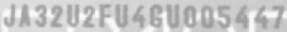

Stolen Vehicle Alerts

The big advantage of telematics-based products and services is that they are beneficial to both sides, and it’s easy to present. One of the examples can be enabling stolen vehicle alerts. By gathering data about customer behavior, insurers can build driver profiles that allow them to set up alerts that are triggered by unusual or suspicious behavior.

For instance, let’s assume a customer typically drives their car between 7am and 5pm on weekdays and then goes on various medium distance trips during the weekend. So an unexpected, high-speed journey at 3am on Wednesday can seem suspicious and trigger an alert. Of course, there can be unforeseen events that force customer behavior like that, but then the policyholder can be contacted to verify whether that’s them using the car and if there’s been an emergency. However, if the verification fails, then authorities can be notified and informed of the vehicle’s position in real-time to help recover the vehicle once it’s been confirmed as stolen.

For fleet owners, geo-fencing rules can be established to enhance fleet security. Many of the businesses with fleets operate during specific working hours. At night the company vehicles are parked in designated lots. So, if there is a situation when a vehicle leaves the specific area during the hours it shouldn’t, an automated alert can be triggered. The fleet manager can be then contacted to verify whether the car is being used by the company or if it’s leaving the property unauthorized. If necessary, authorities can be notified about the theft, and the vehicle location can be tracked to enable swift recovery.

Roadside assistance

Vehicle roadside assistance is a service that assists the driver of a vehicle in case of a breakdown. Vehicle roadside assistance is an effort by auto service professionals to sort minor mechanical and electrical repairs and adjustments in an attempt to make a vehicle drivable again. According to just a single roadside assistance company in the US, they receive 1.76 million calls for help a year, which translates to 5,000 calls every day. Clearly, any automation and expediting of the processes can have a significant impact on the effectiveness of operations and the customer experience.

By employing modern technologies like telematics, insurers can streamline the process from the moment the driver notifies the insurer of a breakdown. The company can start a full process aimed at resolving the issue as fast as possible in the least stressful way. Using vehicle location, a tow truck can be dispatched without the need for the customer to try and pinpoint their location. And the insurer can then proceed to locate and book the nearest available replacement vehicle. Furthermore, using the telematics data, an initial assessment of damage can be performed in order to expedite the repair. As an example, the data may indicate that the vehicle has been overheating for several miles before it stopped and that can be useful information for the garage that will try to fix the car.

Predictive maintenance

There are two types of servicing: reactive and proactive. While reactive requires managing a failure after it occurs, the various proactive maintenance approaches allow for some level of planning to address that failure ahead of time. Proactive maintenance enables better vehicle uptime and higher utilization, especially for fleet owners. Telematics is helping to further improve maintenance practices and optimize uptime on the path to predictive maintenance models.

This type of service is best suited for more modern vehicles where the telematics feature is embedded and there is a multitude of different sensors monitoring the vehicle’s health. However, a more basic level of predictive maintenance is achievable with plug-in telematics dongles and devices able to read fault codes.

Using that data, insurers can remind policyholders about things like oil and brake pad changes, which will have an impact on both road safety and vehicle longevity. They can also send alerts about issues like low tire pressure to encourage drivers to refill the tires with air on their own rather than wait for a puncture and require roadside assistance.

The simple preventive maintenance can ultimately save a lot of stress for the driver as it will prevent more severe issues with the car as well as money and time spent on the repairs. For fleet owners, it means increased uptime and better utilization of the vehicles that in turn lead to an increase in profit and lower costs.

Building Telematics-based Insurance Products - Summing Up

Aside from offering policyholders benefits like fairer, lower rates, streamlined claims resolution, and better roadside assistance, telematics technology is a goldmine of data for the insurers . They get a better understanding of driver behavior and associated risk and can adjust the premiums accordingly. In the event of an accident, an adjuster can find out which part of the car was damaged, how severe the impact was, and what is the probability of passengers suffering injuries. Finally, insurance companies can benefit from reduced administration costs by being able to resolve the claim faster and more efficiently.

We design a fast lane for Financial Services

Build future-ready solutions that learn, predict, and respond in real-time.

Check related articles

Read our blog and stay informed about the industry's latest trends and solutions.

Interested in our services?

Reach out for tailored solutions and expert guidance.