How AI is transforming automotive and car insurance

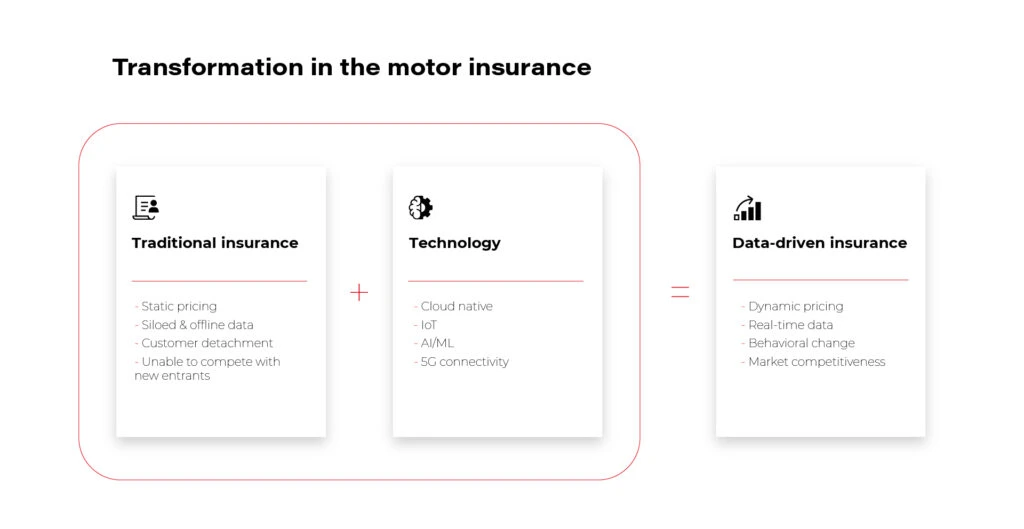

The car insurance industry is experiencing a real revolution today. Insurers are more and more carefully targeting their offers using AI and machine learning features. Such innovations significantly enhance business efficiency, eliminate the risk of accidents and their consequences, and enable adaptation to modern realities.

Changes are needed today

Approximately $25 billion is "frozen" with insurers annually due to problems such as fraud, claims adjustment, delays in service garages, etc. However, customers are not always happy with the insurance amounts they receive and the fact that they often have to accept undervalued rates. The reason for this is that due to limited data, it is difficult to accurately identify the culprit of the incident. It is also often the case that compensation is based on rates lower than the actual value of the damage.

Insurers today need to be aware of the ecosystem in which they operate . Clients are becoming more demanding and, according to an IBM Institute for Business Value (IBV) study, 50 percent of them prefer tailor-made products based on individual quotes. The very model of cooperation between businesses is also changing, as relations between insurance providers and car manufacturers are growing tighter. All of this is linked to the fact that cars are becoming increasingly autonomous, allowing them to more closely monitor traffic incidents and driver behavior as well as manage risk. Estimates suggest there will be as many as one trillion connected devices by 2025, and by 2030 there will be an increasing percentage of vehicles with automated features (ADAS).

No wonder there's an increasing buzz about changes in the car insurance industry. And these are changes based on technology. The use of artificial intelligence , machine learning, and advanced data analytics in the cloud will allow for seamless adaptation to market expectations.

CASE STUDY

SARA Assicurazioni and Automobile Club Italia are already encouraging drivers to install ADAS systems in exchange for a 20% discount on their insurance premiums. Indeed, it has been demonstrated that such systems can slash the rate of liability claims for personal injury by 4-25% and by 7-22% for property damage.

Why is this so important for insurers who want to face the reality?

Artificial intelligence-based pricing models provide a significant reduction in the time needed to introduce new offerings and to make optimal decisions. The risk of being mispriced is also lowered, as is the time it takes to launch insurance products.

The new AI-based insurance reality is happening as we speak. The digital-first companies like Lemonade, with their high flexibility in responding to market changes, are showing customers what solutions are feasible. In doing so, they put pressure on those companies that still hesitate to test new models.

Areas of change in car insurance due to AI

Artificial intelligence and related technologies are having a huge impact on many aspects of the insurance industry : quoting, underwriting, distribution, risk and claims management, and more.

Changes in insurance distribution

Artificial intelligence algorithms smoothly create risk profiles so that the time required to purchase a policy is reduced to minutes. Smart contracts based on blockchain instantly authenticate payments from an online account. At the same time, contract processing and payment verification is also vastly streamlined, reducing insurers' client acquisition cost.

Advanced risk assessment and reliable pricing

Traditionally, insurance premiums are determined using the "cost-plus" method. This includes an actuarial assessment of the risk premium, a component for direct and indirect costs, and a margin. Yet it has quite a few drawbacks.

One of them is the inability to easily account for non-technical price determinants, as well as the inability to react quickly to shifting market conditions.

How is risk calculated? For car insurance companies, the assessment refers to accidents, road crashes, breakdowns, theft, and fatalities.

These days, all these aspects can be controlled by leveraging AI, coupled with IoT data that provides real-time insights. Customized pricing of policies, for instance, can take into account GPS device dataon a vehicle’s location, speed, and distance traveled. This way, you can see whether the vehicle spends most of its time in the driveway or if, conversely, it frequently travels on highways, particularly at excessive speeds.

In addition, insurance companies can use a host of other sensor and camera data, as well as reports and documents from previous claims. Having all this information gathered, algorithms are able to reliably determine risk profiles.

CASE STUDY

Ant Financial, a Chinese company that offers an ecosystem of merged digital products and services, specializes in creating highly detailed customer profiles. Their technology is based on artificial intelligence algorithms that assign car insurance points to each customer, similarly to credit scoring. They take into account such detailed factors as lifestyle and habits. Based on this, the app shows an individual score, assigning a product that matches the specific policyholder.

An in-depth analysis of claims

The cooperation between an insurance company and its client is based on the premise that both parties are pursuing to avoid potential losses. Unfortunately, sometimes accidents, breakdowns or thefts occur and a claims process must be implemented. Artificial intelligence, integrated IoT data, and telematics come in handy irrespective of the type of claims we are handling.

- These technologies are suitable for, among other things, automatically generating not only damage information but also repair cost estimates.

- Machine learning techniques can estimate the average cost of claims for various client segments.

- Sending real-time alerts, in turn, enables the implementation of predictive maintenance.

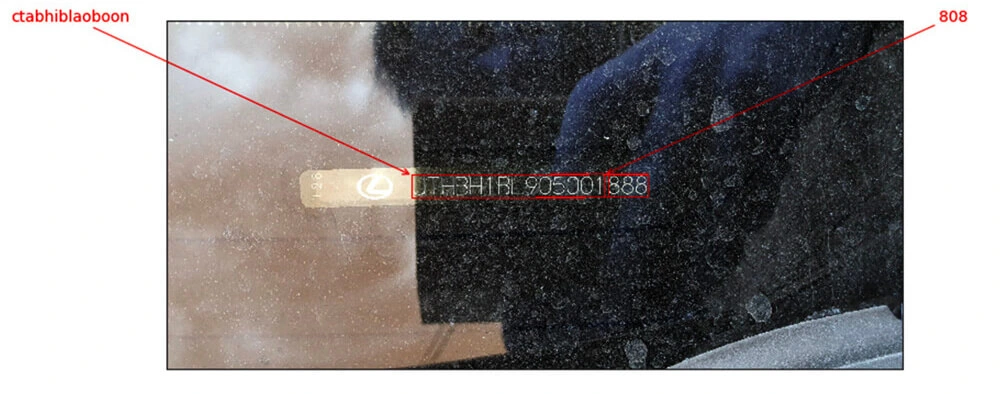

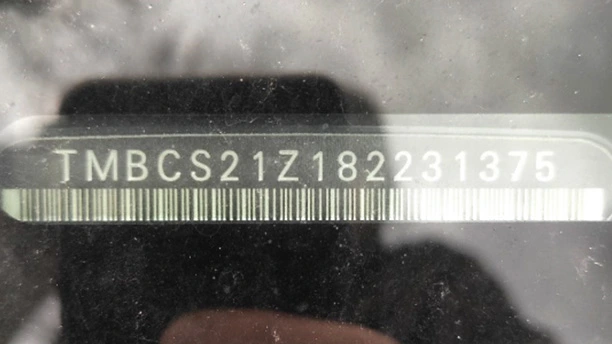

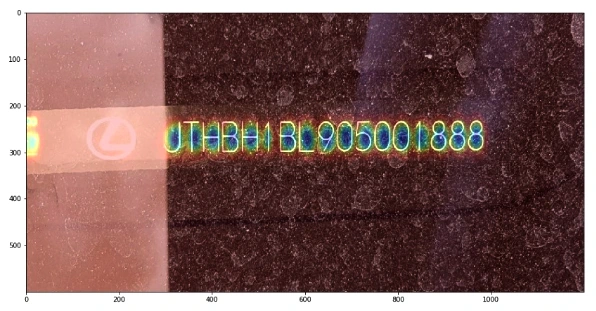

- Once an image has been uploaded, an extensive database of parts and prices can be created.

The drivers themselves gain control as they can carry out the process of registering the damage from A to Z: take a photo, upload it to the insurer's platform and get an instant quote for the repair costs. From now on, they are no longer reliant on workshop quotes, which were often highly overestimated in line with the principle: "the insurer will pay anyway".

Fraud prevention

29 billion dollars in annual losses These are losses to auto insurers that occur due to fraud. Fraudsters want to scam a company out of insurance money based on illegally orchestrated events. How to prevent this? The answer is AI.

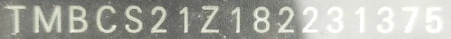

Analyzed data retrieved from cameras and sensors can reconstruct the details of a car accident with high precision. So, having an accident timeline generated by artificial intelligence facilitates accident investigation and claims management.

CASE STUDY

An advanced AI-based incident reconstruction has been tested lately on 200,000 vehicles as part of a collaboration between Israel's Project Nexar and a Japanese insurance company.

Assistance in the event of accidents

According to data from the OECD, car accident fatalities could be reduced by 44 percent if emergency medical services had access to real-time information about the injuries of involved parties.

Still, real-time assistance has great potential not only for public services but also in the context of auto insurance.

By leveraging AI to perform this, insurers can provide drivers with quick and semi-automated responses during collisions and accidents . For example, a chatbot can instruct the driver on how to behave, how to call for help, or how to help fellow passengers. All this is essential in the context of saving lives. At the same time, it is a way of reducing the consequences of an accident.

Transparent decision making (client perspective)

New technologies offer solutions to many problems not only for insurers but also for clients. The latter often complain about discrimination and unfair, from their point of view, calculations of policies and compensation.

"Smart automated gatekeepers" are superior in multiple ways to the imperfect solutions of traditional models. This is because, based on a number of reliable parameters, they facilitate the creation of more authoritative and personalized pricing policies. Data-rich and automated risk and damage assessments pay off for consumers because they have decision-making power based on how their actions affect insurance coverage.

The opportunities and future of AI in car insurance

McKinsey's analysis says that across functions and use cases AI investments are worth $1.1 trillion in potential annual value for the insurance industry.

The direction of changes is outlined in two ways: first by increasingly connected and software-equipped vehicles with more sensors. Second, by the changing analytical skills of insurers. Data-driven vehicles will certainly affect more reliable and real-time consistent repair costs and, consequently, claims payments. And when it comes to planning offers and understanding the client, AI is an enabler of change for personalized, real-time service (24/7 virtual assistance) and for creating flexible policies. All signs indicate that such "abstract" parameters as education or earnings will cease to play a major role in this regard.

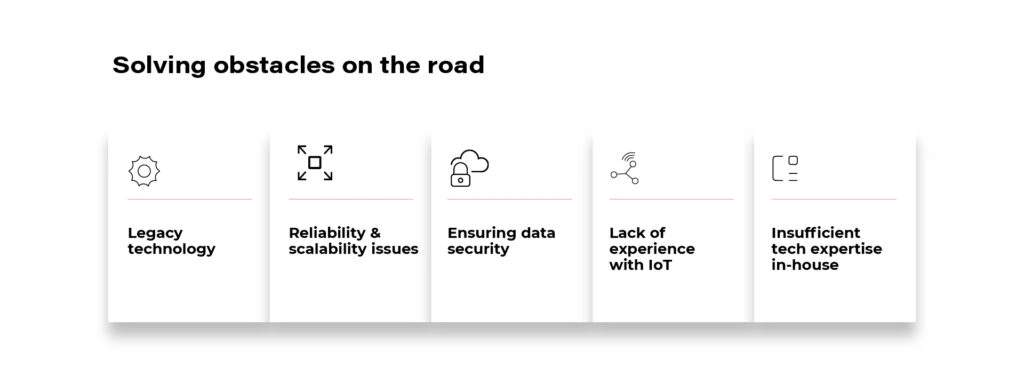

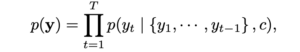

As can be inferred from the diagram above, the greater the impact of a given technology on an insurance company's business , the longer the time required for its implementation. Therefore, it is vital to consider the future on a macro scale, by planning the strategy not for 2 years, but for 10.

The decisions you make today have a bearing on improving operational efficiency, minimizing costs, and opening up to individual client needs, which are becoming more and more coupled with digital technologies.

Grape Up guides enterprises on their data-driven transformation journey

Ready to ship? Let's talk.

Check related articles

Read our blog and stay informed about the industry's latest trends and solutions.

Interested in our services?

Reach out for tailored solutions and expert guidance.